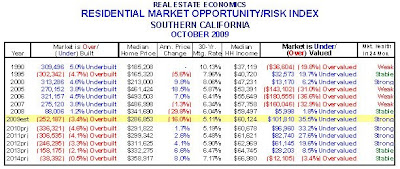

The state budget deficit has intensified record high unemployment levels, slowing the housing recovery in Southern California. However, the worst may be over for housing. Strong depreciation has stimulated strong demand for bargain priced properties, leading to historic under valuation for housing in Southern California as seen in the following Opportunity / Risk Index:

This index factors the keys indicators of jobs-to-housing and mortgage cost-to-income relationships in order to define housing market health and forecast the housing recovery in Southern California. Despite the loss of housing values and high level of price over correction, mild price appreciation will not resume until economic growth emerges, which will not likely occur until the latter part of 2010/early 2011.

Overall market conditions should improve significantly during 2011 as the economy begins to expand, lending restrictions begin to ease, and increasing numbers of potential buyers recognize the historically strong housing values.

Mark Boud

http://www.realestateeconomics.com/